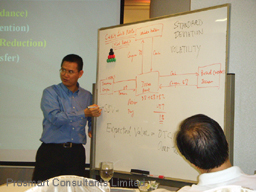

Prosmart's Consultant Lecturing in Risk Management Course of a Continuing Education Fund (CEF) Sponsored Entrepreneur MBA Programme

綽越顧問講授持續進修基金(“CEF”)支助的企業家工商管理(“EMBA”)證書課程風險管理科目

Day 2 (5 Aug 2007)

Prosmart was appointed to lecture in FUD117 Risk Management, one of the 10 courses offered in an Entrepreneur MBA (“EMBA”) Certificate Programme sponsored by HKSAR Government's Continuing Education Fund (CEF) on 4-5 August 2007 at the Meeeting Room on 8/F Royal Plaza Hotel, New Century Plaza, Kowloon.

In line with the request to emphasize sharing of actual business experiences, Prosmart conducted the course in the unprecedented interactive workshop format, with a fair amount of small group discussions and presentations. Conducting this workshop was Ken Po, Prosmart's risk management specialist, who was assisted by David Pun, Learning & Business Development Director of Prosmart.

第二天(2007年8月5日)

綽越被任命為香港特別行政區政府持續進修基金支助的企業家工商管理證書 (“EMBA”)課程10個科目中的FUD117風險管理負責講授,該科目於2007年8月4-5日在九龍新世纪廣場帝京酒店8樓會議室舉行。

為符合著重分享實戰業務經驗的要求,綽越運用空前的互動工作坊形式指導學員,課程中融入很多小組討論及由學員分享討論結果。主持此次工作坊的是綽越的風險管理專家顧問布錦二先生,並由綽越的學習與業務發展董事潘國樑先生從旁協助。

|

Ken Po defining the assessment of risk as a process which comes after risk recognition. 布錦二為風險確認後應做的風險評估程序作定義。 |

|

Highlighting the different tools and methods used in analyzing risk. 重點介紹不同的風險分析工具與方法。 |

|

Explaining how to use probability, occurrence frequency and expected values in quantifying risk. 解釋怎樣運用機率理論、發生頻率及預期數值做風險數量的量度。 |

|

Highlighting the objectives of controlling risk. 重點講述風險控制的目的。 |

|

Explaining how to use statistical tools in assessing and quantifying risk. 解釋怎樣運用統計學工具以評估及量度風險。 |

|

Looking into different methods in controlling risk. 深入探討不同的風險控制方法。 |

|

A small group discussing the real life example of operational crisis management in Mainland China retail industry. 小組在討論內地的營運危機管理的真實案例。 |

|

Presentation by a student on her group's findings in handling the operational crisis. 學員在講述小組討論處理營運危機所達成的結果。 |

|

Group discussing what specific details should be included in a Disaster Recovery Plan (“DRP”). 小組在討論災難復原計畫(“DRP”)應關注什麼具體細節。 |

|

Ken Po presenting various risk management areas in the case study of HSBC. 布錦二講述滙豐銀行真實案例中的風險管理範圍。 |

|

Highlighting the sources of HSBC's market risk such as interest, exchange rates, stock and commodities and the method in quantifying risk tolerance. 重點介紹滙豐銀行市場風險的來源,如利率、匯率、股票和商品價格之變動及量度所承受的市場風險。 |

|

Group photo of participants taken at the end of the 1 1/2 day CEF EMBA Certificate Risk Management Course. 1天半的CEF EMBA證書課程風險管理科目完成後全體學員拍照留念。 |

© Prosmart Consultants Limited 2005 - 2016. All rights reserved.